Practical legal publications to empower your law firm

Enjoy practice more with our extensive library of matter plans with precedents, letters, forms, and commentaries for all the common areas of law.

Trusted, respected and current.

Enjoy practice more with By Lawyers Legal Guides and Precedents

Up to date legal guidance from start to finish

Reduce research time and stay up to date with By Lawyers legal precedents, matter plans and legal commentary. By Lawyers publications provide the resources to progress a matter from start to finish.

Browse all areas of law

Written and curated by experienced legal practitioners

Practice with confidence. Our legal publications are monitored daily, keeping them current with the law and practice. They are written by practising lawyers with extensive practical experience.

Meet our authors

Over 27,000 legal professionals use By Lawyers daily

Trusted by over 27,000 legal professionals, By Lawyers legal guides and precedents are written in plain English and easy to follow for everyone in the firm.

About Us

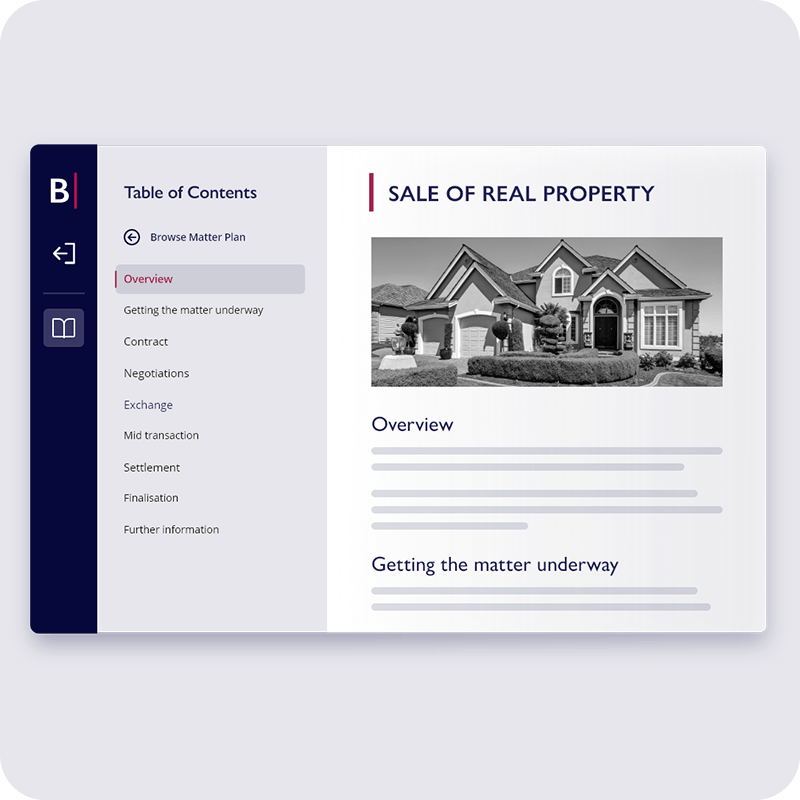

Easily navigate matters with the By Lawyers matter plan

Confidently handle matters in new or less familiar areas of Law. Matter plans provide a sequential system for conducting a matter from start to finish. Our matter plans include all the necessary letters, documents and legal forms, as well as practical legal commentary, at every stage of the matter, from opening to closing the file.

Find answers quickly with practical commentary

By Lawyers commentary provides practical and detailed guidance in all the common areas of law. Easily accessible through the matter plan, the informative commentaries include direct links to relevant legislation, cases and websites, providing access to all the resources required to conduct a matter.

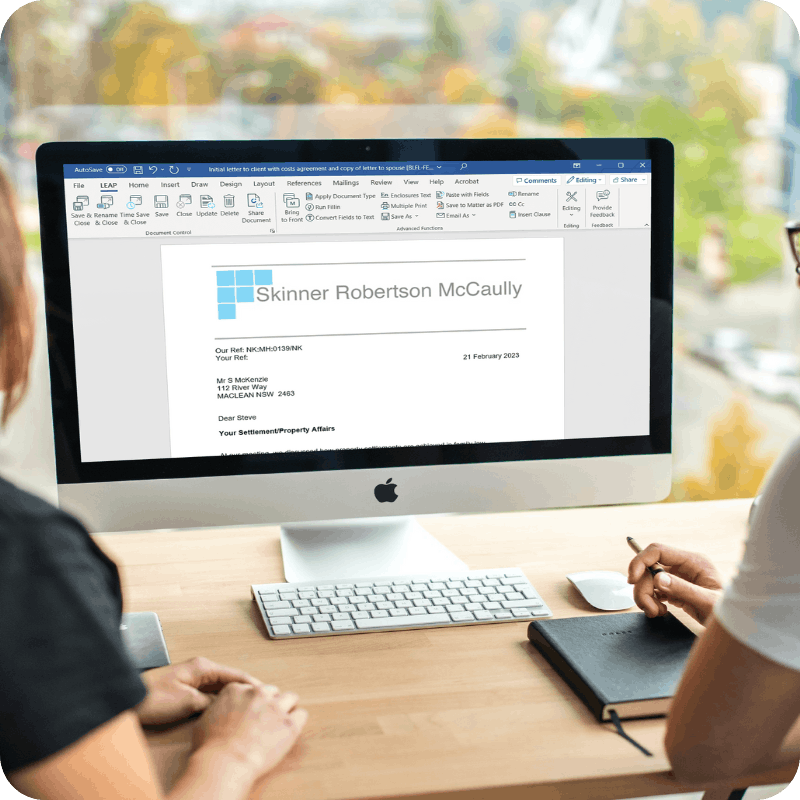

Save time with legally drafted precedents

Save time drafting with By Lawyers precedents, expertly written and refined by experienced legal practitioners. Our precedents are continually reviewed and updated in line with changes in the law and practice so you can stay confident that the information you’re providing to clients is accurate and consistent.

Browse Popular Areas of Law

Customer Success Stories

"‘I have found the Wills, Powers and Advance Care Directives publication to be very useful. I now have a small family law matter to do – not an area I usually practice in. I am considering purchasing the By Lawyers Family Law publication as I found the other publication very useful".

Dezi George

Hristoforos & George Solicitors VIC

"By Lawyers has really helped our firm to navigate a range of complex legal matters".

Youssef Maksisi

Maksisi Lawyers NSW

"We found starting with By Lawyers an absolute necessity, as it provides an impressive library of precedents".

Advantage Legal Pty Ltd NSW

"I use By Lawyers in my family law and estates practice. My assistant uses the commentaries to help her progress matters when I am not there, and I use 101 Family Law Answers for more detailed research on case law when I need it. We use the precedents such as orders, letters, and wills. I feel safe knowing that my By Lawyers precedents are always kept up to date, so I don’t have to worry about the documents I’m using being wrong. This allows me to concentrate on my clients. As a sole practitioner, I find By Lawyers enormously helpful, I’d be lost without it!"

Nicole Kelly

Nicole Kelly Legal SA

Need Help?

Visit our Frequently Asked Questions for more information. Find answers, quick tips and the help you need to easily navigate our matter plans, forms and legal precedents, all in one place.

FAQs & Help